Eliminate the gas tax entirely and replace it with a weight and mileage based tax on commercial freight shipping.

Cars put next to no strain on the roads. Freight trucks put a disproportionate amount of strain on the roads.

https://www.gao.gov/products/109954

a five-axle, tractor-trailer loaded to the 80,000-pound Federal limit, has the same impact on an interstate highway as 9,600 automobiles

a truck axle carrying 18,000 pounds is only 9 times heavier than a 2,000-pound automobile axle, it does 5,000 times more damage

https://en.wikipedia.org/wiki/Fourth_power_law

Since the roads have to be built to tolerate trucks, the impact of the cars on the road are effectively negligible. We also already have a system for regularly weighing and monitoring the millage on freight trucks.

Damage to roads isn’t the only externality that we should be costing in though. The congestion caused by cars is estimated to have cost the Australian economy $19 billion in 2016, and was forecast to rise as high as nearly $40 billion by 2031. In a place even more car dependent than we are like most of America, that number would be dwarfed. And that’s without taking into account the social cost of all the time wasted in cars, and the health and environmental cost of tyre microplastic pollution and the more sedentary lifestyle that comes with driving compared to cycling especially, but even public transport (which typically requires walking to and from the station).

There are a lot of good reasons to want to strongly discourage the use of private cars wherever possible, in favour of public and active transport, beyond merely the cost of maintaining roads.

People really hate this, but demand based pricing for express routes makes a lot of sense for this reason. That effectively creates clear routes for bus rapid transit and emergency vehicles which are subsidized by the high rush hour tolls.

The choices on my commute right now are to sit in traffic for almost an hour, pay $15 to use the express lane (20 minute commute), or pay $2 for the bus which uses the express lanes (35 minute commute).

I mostly ride a bike which takes about 30 minutes, but it is nice to have the bus option for when it is very cold.

Sure. We should do those things and you’re correct. That doesn’t have much bearing on how we replace the road maintenance funding.

Additionally, if you raise taxes to incentise public transport, you should make sure public transport exists first. In the US it’s entirely possible for a commute that would be a 20 minute drive to take hours via the bus, only run twice a day, have no notice of cancellations, and involve walking part of the way on a 50 mph road with no sidewalk.We shouldn’t sacrifice improvements to where we are because it doesn’t get us to where we should eventually be.

The only problem I see with this is that it will sort the burden of this tax from vehicle users to consumers. My guess is that people who drive lots are statistically now likely to be wealthy.

Define “drive lots”. Working class citizens can easily have 60 mile commutes for work. Add in road trips for vacations and families are easily throwing down hundreds of thousands of miles. I wouldn’t say they’re are wealthy.

If you’re actually wealthy, you’d be flying for any significant distances.

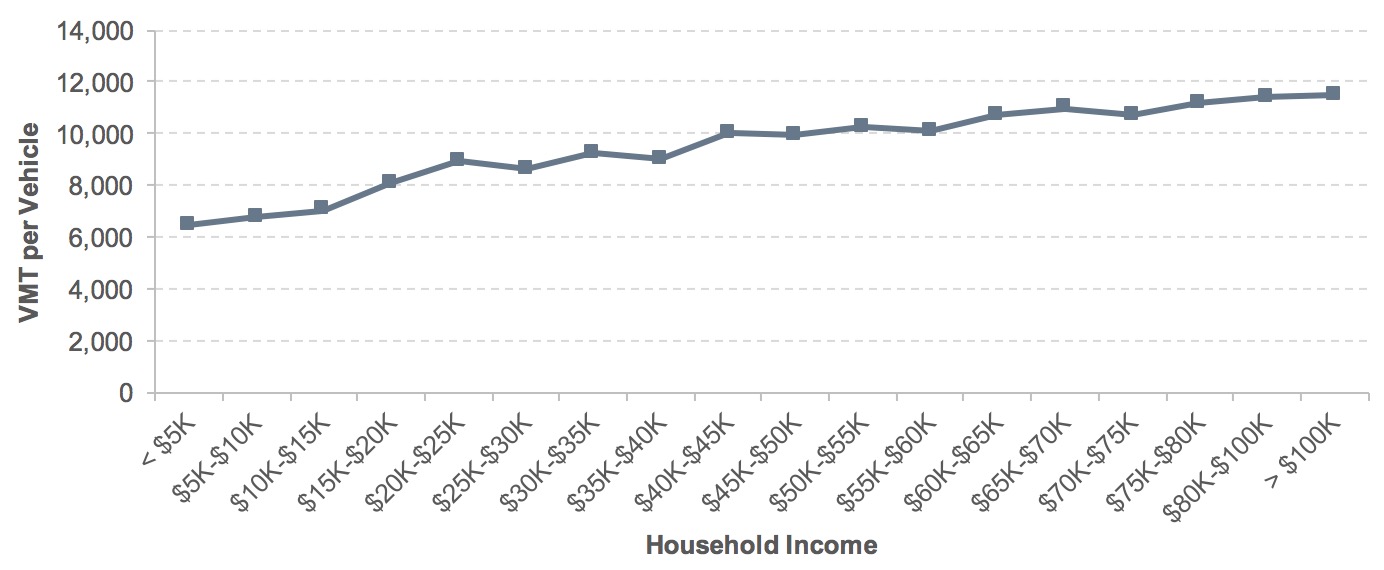

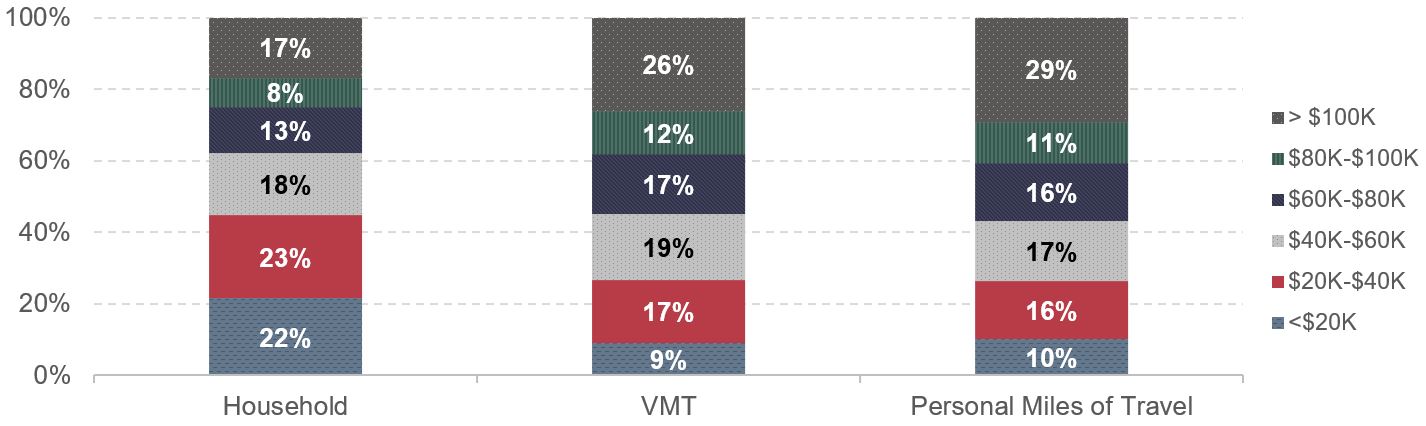

maybe you’re right. i would like to see some research about road usage and wealth and the correlation between the two before changing this law though.

https://data.bts.gov/stories/s/ida7-k95k

https://www.bts.gov/data-spotlight/household-cost-transportation-it-affordable

https://www.fhwa.dot.gov/policy/23cpr/chap3.cfm

From the last link since it’s long. Vmt is vehicle miles traveled, and pmt is person miles traveled:

Tldr: road usage is higher for higher income people, but it makes up a smaller percentage of their income. Reducing transportation costs has a greater benefit for low income households than high income households.

Fair enough, thanks for informing me.

The problem is that long term, subsidizing driving makes everything worse and more expensive, especially for low income folks. So while considering effects of policy on low income folks is good, we should not look at this and conclude that eliminating marginal driving costs is a good thing.

So, in principle I agree. However, drawing road maintenance funding from something other than a regressive tax isn’t the same as subsidization. It similarly lowers the burden on some, but it’s just shifting it to those both more able to shoulder the burden, and those more responsible for it. They’re also the most able to find alternative modes of transport, since freight rail actually exists in a consistent way across the country, and last mile freight delivery is a continued use case for city roads even if we massively reduce our individual reliance on automobiles.

Secondly, it’s worth noting that this isn’t just automobile costs, but these reports also cover transportation in general. The cost of transportation is more of a burden for low income folks regardless of mode. Before we start considering denying relief or actively disincentivising one mode of transport, we need to ensure that an alternative actually exists. Without that step you’re not reducing our reliance on cars, your just punishing poor people for society not caring about light rail or walkable cities.

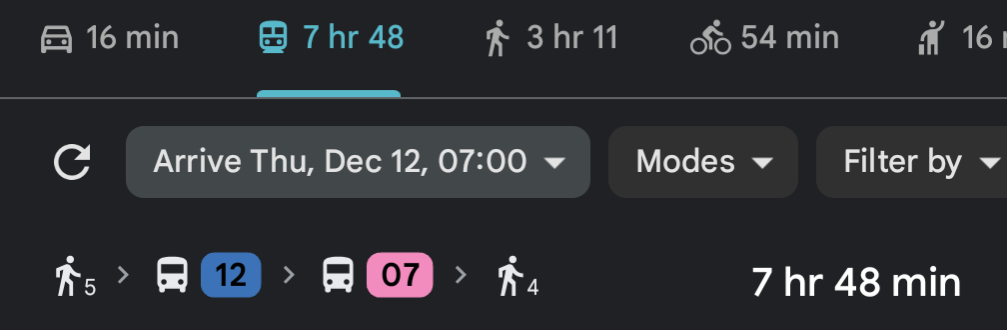

My city has a pretty good bus system compared to most, and there are parts of town that are practically unreachable without a car, and actually unreachable in a safe fashion in the winter. As a quick reference, I looked up the bus route for getting to my doctor’s office by 7am, which isn’t unreasonable for some of the businesses near it.

For reference, the walking instructions involve a fair bit of time on a pedestrian hostile bit of road with a lot of trucks and no sidewalks. It’s forecast to be roughly 9°F during that time and snowing.

It does only take an hour by bus if you can show up at eight instead.All that to say, I’m 100% in favor of getting rid of cars. We just need a society where I can get to my doctor’s office without one first.

And even then, trucks should still pay for maintenance.I think all these policy nudges need to happen in tandem. We can update how we tax vehicle use while shifting that money to transit, and doing zoning reform. If we wait until there is a perfect bus route everywhere before charging something resembling market rate for clearly unsustainable vehicle use, nothing will ever change. We can use the funding to help low income folks specifically, sure. I’m approaching this more from a traffic violence and climate change angle though. The status quo isn’t acceptable and already imposes tremendous burden on society.

I’d prefer a carbon fee and dividend as the main policy personally, but in the meantime I’ll keep advocating for anything that incentivizes less driving. Maintenance to me has to be tied to use, and we can figure out how to do that fairly without making unlimited driving approach zero marginal costs. Things will get a whole lot worse for low income folks if we do nothing.

deleted by creator

Eh, I don’t know that it’s unfair though.

Even non drivers end up benefiting from freight hauling. Without it, we’d all have to go and pick things up. Centralizing the taxation for upkeep, even though it will get passed on to consumers actually seems like a fairly balanced idea on the surface.

It’s a new idea to me, and I haven’t picked it apart much yet though.

Playing with it in my head as I write, the only real hole I can see is with goods that are so essential that even a small increase in cost becomes a bigger burden on lower incomes. But negating the taxes for those items in specific should remove that burden, so things like food don’t get absurd.

Since it would also solve for part of the increased administration costs, since expanding an existing system is easier than creating a new one, it’s just as viable as taxing the “fuel” by metering recharging.

Maybe I’m missing something, but it seems like a viable option once exactly which goods need to be either tax exempt, or taxed at a lower rate

I’m not sure that your guess is correct. The gass tax is an example of a regressive tax. Higher income people are generally more able to work from home, and own higher efficiency vehicles. Even ignoring efficiency, a person making $200k would pay the same for road maintenance as a person making $30k. As a proportion of income, the tax hits lower income people harder.

At the same time, we don’t actually want to penalize people for having more efficient cars. So dropping the tax on individuals and shifting it to the main driver behind road wear makes sense. The cost will inevitably be passed on to consumers, but spreading $60 billion over all the products sold in the US in a year is a smaller burden for low income people, particularly if weight is factored in.

Fair point, I think I might be persuaded

“we don’t actually want to penalize people for having more efficient cars”

Yes we do - more efficient cars is not the same as more efficient means of transport, and even electric cars have far higher emissions per person than buses or trains or bikes or walking.

Everyone has this weird mental block where they can’t imagine a solution that’s not cars (mainly because our built environment is mostly roads), but the reality is that electric cars are just a stopgap except for in the boonies, and in those cases using petrol isn’t that big of a deal anyway (it’s ~10% of the population so it’s only a tiny fraction of the car-emissions problem, air pollution is less because there are fewer cars and fewer people nearby, and EVs are more expensive because you can’t just drive a cheap short-range city-car like the Nissan Leaf). So rural transport emissions should be a low priority IMO.

To be clear, I’m all for taxing the shit out of commercial trucks too. Most of that shit should be put on rail (and it would, if we focused on improving rail infrastructure like we currently focus on improving highways), and so should most car drivers.

You misunderstand my intent with that sentence. We don’t want to punish someone for having an EV as opposed to an ICE vehicle. If someone is buying a car, we would prefer to gently nudge them towards the more efficient vehicle, if only through the savings of efficiency.

I’m entirely aware of the alternatives to cars, and would rather we have those. However, we don’t live in a world yet where cars are only needed for rural populations and we won’t get to that world in the timeframe where we need to figure out road maintenance financing, which is currently based on gasoline sales. So we should figure out the current finance issue in a way that doesn’t punish people for picking the best available option, even if it’s not the best possible option. Or at least doesn’t punish them more than the worse options.

Perhaps it would help nudge more sustainable transport systems. While being a tax for road infrastructure wear and tear, it can effectively be a bit of a carbon tax too.

Now, the rail infrastructure and operators in North America are abysmal, but our countries were literally built by rail, I don’t see why we can’t continue to use rail as a more sustainable alternative to longer haul trucking. Rail operators being inept shouldn’t be an excuse to explore these options.

My guess is that people who drive lots are statistically now likely to be wealthy.

Nope, lol.

For close to 15 years I had a 110 mile daily commute (round trip) to work because I lived in the boonies. Was/am totally not wealthy. That was just required driving and no pleasure trips, extra trips, etc.

You understand the difference between ‘statistically’ and ‘in my own singular personal experience’, right?

I do, but I also know that I’m not alone in that experience.

cars put more strain on roads than bikes, walking and unicycling

I’ve seen one guy getting around my area on a bike in the last fifteen years. It lasted maybe two months. I hope he didn’t die, but I’m sure he had a few near death experiences. The last time I tried to walk two miles home from the car shop I had three people stop and offer me a ride because it is that deadly. Just narrow two lane roads, no shoulder and a ditch. I’m inside the 275 loop in Cincinnati, I’m not out in rural nowhere.

We can’t all ride bikes. That doesn’t even touch people wirh physical limitations.

Had to add an edit to say Cincinnati people are awesome, thanks for offering the rides!

They do. I’m also in favor of tearing out intracity highways, converting roads in urban centers in walkable spaces, and shifting zoning to encourage the density required for those to be actually viable transportation.

Those are all super tall orders though, so I’m happy to start with shifting the financial burden for road maintenance to those mainly driving it (🥁)

Cars may do more, but for maintenance spending a car and a pedestrian have exactly the same impact.

Has there been any politicians that have pushed for taxing freight trucks instead of people?

Nope, nope, they can fuck right off using built in GPS shit. That’s already too invasive.

Put fucking meters on chargers. That’s the fucking answer. At home, you get a fucking tax bill based on that meter. Away from home, you pay it at the “pump”, just like gas.

Does out come with its own problems, yes, but not with more invasive bullshit

I don’t see why just an odometer reading at insurance renewal wouldn’t work. Vehicles would have to be registered by location of primary residence or place of business to limit avoidance of the tax, but then no tracking and no meters on every single possible charging device.

Sure, there’d be cross state/province travel, but would probably be negligible in the end.

That would work fine too, just less immediate, which is a minor aspect for sure. A lot of people will buck at paying a hundred bucks a year (as an example), but won’t think about 12 cents per gallon (or its equivalent) unless that rate changes.

But it would definitely cost less to implement for sure, what with no bed need to roll put meters.

A meter on a charger will be way too easy to circumvent. We’ve owned 2 EVs now and both came with portable chargers. Tesla also has a portable charger that you can plug into anything from a standard 110 outlet all the way up to 50 amp 220 volt outlets. All of those portable chargers would need meters as well, along with some way to ensure they are properly registered, read when used, etc.

If meters on chargers were mandated then you’d likely see an influx of unmetered mobile chargers from other countries as a way to circumvent the tax.

Edit: We have also charged for free at complementary chargers at parking garages, hotels, restaurants, stores, etc. If chargers started being taxed I bet a lot of those complimentary chargers would simply disappear rather than the owners paying the tax or trying to figure out how to collect it from users.

Eh, I’m not worried about that even a hair as much as the privacy invasion. I’d rather have a thousand tax evaders (that will get caught eventually anyway) than one person being subjected to yet another means of tracking them without due process.

Should be linked to the weight of the vehicle s as well.

To the fourth power, to price in the approximate effect on road wear.

Road wear scales quartically with vehicle weight?

So it is, though it scales with the load per axle, not the total weight of the vehicle.

I have no problem with this so you mean I still pay less than I would for gas and less CO2 and it incentives people to drive less or carpool?

Is there a reason that road maintenance funding has to be tied to the vehicles which drive on them? Just because I live in a city and never drive anywhere doesn’t mean I don’t take buses or use goods transported by road. Should my taxes not contribute to the upkeep?

That should be baked into the bus fare (which should be subsidized anyway). We want to link road maintenance to usage as directly as possible to incentivize driving less. Flat fees, or convoluted schemes break this link and effectively encourage unlimited driving. A per mile fee tied to the weight of the vehicle should be the most fair.

We want to link road maintenance to usage as directly as possible to incentivize driving less

That makes sense.

A per mile fee tied to the weight of the vehicle should be the most fair

That sounds like a good idea. The weight of the vehicle is easy to determine. The distance is harder for the government to measure, which is the topic of the OP.

If you’re in the U.S, afaik you’re already paying for the local roads, as gas tax does not fund them.

On top of that, it’s probably good if heavy users pay proportionally - it’s not a particularly good idea to subsidize road overuse.

Ah, I’m in Canada, where it looks like some portion of the gas tax funds road repair.

it’s not a particularly good idea to subsidize road overuse

Fair enough, that is an excellent point.

This is already how motorways work in France. But at least there’s always a non-payment option for those that need it, you can just use the sliwer non-motorway roads