Crime. Corruption. Spending a few hundred million on tax lawyers.

We need to raise corporate taxes back to 90%. Before yall get your nuts all twisted. They could write off most of that back in the day by raising wages and reinvesting into the company to grow it.

THAT is what built the industrial juggernaut that won the Cold War. That was the main cause. It’s what made the US economy so indomitable.

Nowadays they pay a pittance and reinvest nothing. They stagnate wage growth. And that’s why we’ve been stuck in this boom bust cycle for decades.

Exactly. Nobody will ever actually pay a 90% income tax rate, nor should they. The purpose of a 90% top-tier income tax rate is to convince them to actually spend their money in the economy instead of hoarding it in financial assets.

You know what you get with that? Bell labs.

Bell Labs is credited with the development of radio astronomy, the transistor, the laser, the photovoltaic cell, the charge-coupled device (CCD), information theory, the Unix operating system, and the programming languages B, C, C++, S, SNOBOL, AWK, AMPL, and others, throughout the 20th century. Ten Nobel Prizes and five Turing Awards have been awarded for work completed at Bell Laboratories.

I’ve never heard this argument before. Do you have any good articles or books to recommend on the subject?

Suppose you’re $10,000 into the top tier, and the top tier is taxed at 91%. That means you have a choice.

You can take 9% of that money and use it for any personal purpose, such as padding your investment portfolio.

Or, you can take 100% of that money, and use it for a “business purpose”. Maybe you put that money toward the salary of your best worker. Maybe you give a bonus to your research team. The point is that you can find a way to get $10,000 of business value from that money, or you can get $900 of personal value from that money.

Maybe you decide to try to defraud the IRS and claim a personal expense as a business expense. You put it towards a new car, claiming you need something better to get you to business meetings. You buy a car with that money, and in doing so, you give the seller a paycheck. Your act of tax fraud still achieves the purpose of the punitive tax rate: putting that money into the pockets of workers.

Our current top tier tax rate is 37%. Now, you have the option of $10,000 of business value, or $6,300 of personal value. Put that $6300 into an index fund and it doesn’t go to workers. With this tax structure, of course worker wages are going to stagnate. They can’t see the “carrot” and there is no “stick” to incentivize business spending.

tl;dr: multiple loopholes that are almost exclusively utilized by the wealthy.

they should not exist for anyone.

It shouldn’t, but it was what Theodore Roosevelt set out to fix over 100 years ago. You can dislike his other views but Teddy’s views on creating national parks, protecting wildlife and fighting large amounts of wealth being continuously passed down all appeared to be for the greater good of humanity.

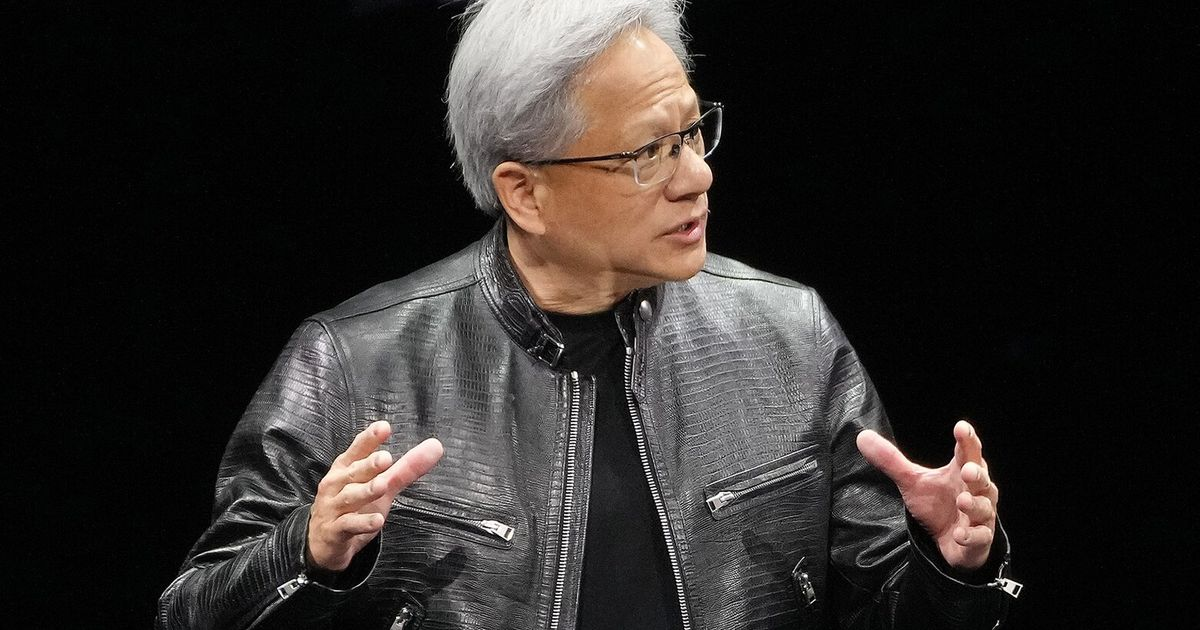

When is NVidia’s next investors conference? Will it be in New York? Asking for a friend….

Reports say three bullet cases were found with the words “Embrace, extend, and extinguish” carved into them.

I figured you’d go with torvalds quote instead

“Nvidia, fuck you”

“HitScan > RayTrace”

eat the rich

Gentlemen, start your engines, load your guns

The more you buy, the more you save!