With high interest rates and inflation hitting household budgets,

goes looking for data

Hmm. This is odd. So, the article states that rates of auto repossession were higher than last year.

This says that delinquency rates on auto loans – not quite the same thing, but probably a better sign of financial stress than repossession rate, if anything, were exceptionally high last year, according from this article in late 2023:

https://www.forbes.com/advisor/auto-loans/late-car-payments-heavy-loan-rates/

Borrowers are falling behind on car loan payments at the highest rate in 27 years. And subprime borrowers—those with credit scores below 640—are struggling the most to keep up with their monthly payments, according to the latest data from Fitch.

This graph shows that delinquency rates were low during COVID-19, but started rising after:

https://ycharts.com/indicators/us_auto_loans_delinquent_by_90_days

But this shows that loan delinquency in general, not auto loans, is up relative to the past ten years and especially relative to the very low rate during COVID-19, but if anything low over the past 30:

https://fred.stlouisfed.org/series/DRCLACBS

That’d seem to suggest that the issue is specific to auto loans, which is not really what I’d expect if interest rates and inflation are the main factors, as those should be agnostic to type of loan.

looks further

This shows that the interest rate – nominal – on new auto loans is high relative to the past 10 years:

https://www.statista.com/statistics/290673/auto-loan-rates-usa/

Interest rates on mortgages are high relative to the last ten years, but are about par for the course over the last thirty:

https://fred.stlouisfed.org/series/MORTGAGE30US

I’d think that things that’d tend to explain something like that would be autos being more expensive than in the past, resulting in them specifically being less-affordable. There are two data points I’d have that support that: I recall from past reading that during and after COVID-19, supply chain disruption resulted in reduced production, which resulted in higher prices for what supply was available, which resulted in used car (as a partial substitute good for new cars) prices rising. Also, the Forbes article above from October 2023 specifically says that auto prices are high (though it doesn’t say whether that’s in real or nominal terms):

Vehicles have also gotten more expensive. The average transaction price of a new car was $47,899 in September, down only slightly from record highs reached earlier in 2023, according to a Kelley Blue Book report. Prices for used cars also remain high, after being driven up dramatically amid supply chain snags in the new car market during the pandemic.

EDIT: Oh, I think I know part of what’s going on. The bit above isn’t saying that auto delinquency rates are the highest they’ve been in 27 years. They’re saying that they’re increasing at the fastest rate that they have in the past 27 years, which is more-understandable, coming off of a period of low interest rates to high interest rates.

The article is slightly dishonest/deceiving. They say we are up over 2019, yet the presentation they reference claims we should have fewer this year than 2019. (slide 40).

To add to what you said, it’s not only the cost of autos that is higher (and that includes payments adjusted for interest rates) but also car repairs are far more expensive. Often loans on used cars, and even new cars extend beyond the warranty and when things break and it’s going to be $11K to fix it, people just stop making payments and let them take the piece of shit back.

Thank you for the very relevant and well-referenced data analysis!

I wonder how much of this has to do with opportunistic price inflation within the industry.

A little dishonest not to mention that they fell by like 30% from 2017 to 2022. This feels more like a return to a pre-pandemic level.

Also odd that they ignore that the presentation they reference claims we should have fewer this year than 2019. (slide 40)

I’ve been screaming it practically at people that were seeing a ton of things returning to pre pandemic levels this year as a ton of government money/programs ran out. There’s going to be an adjustment for people where they freak out and think everything is a sign of a recession, but I’m just not seeing any of those same signs. That’s not to say things aren’t going great, but it’s definitely not like a lot of these articles where they try to sound an alarm that doesn’t need to be sounded.

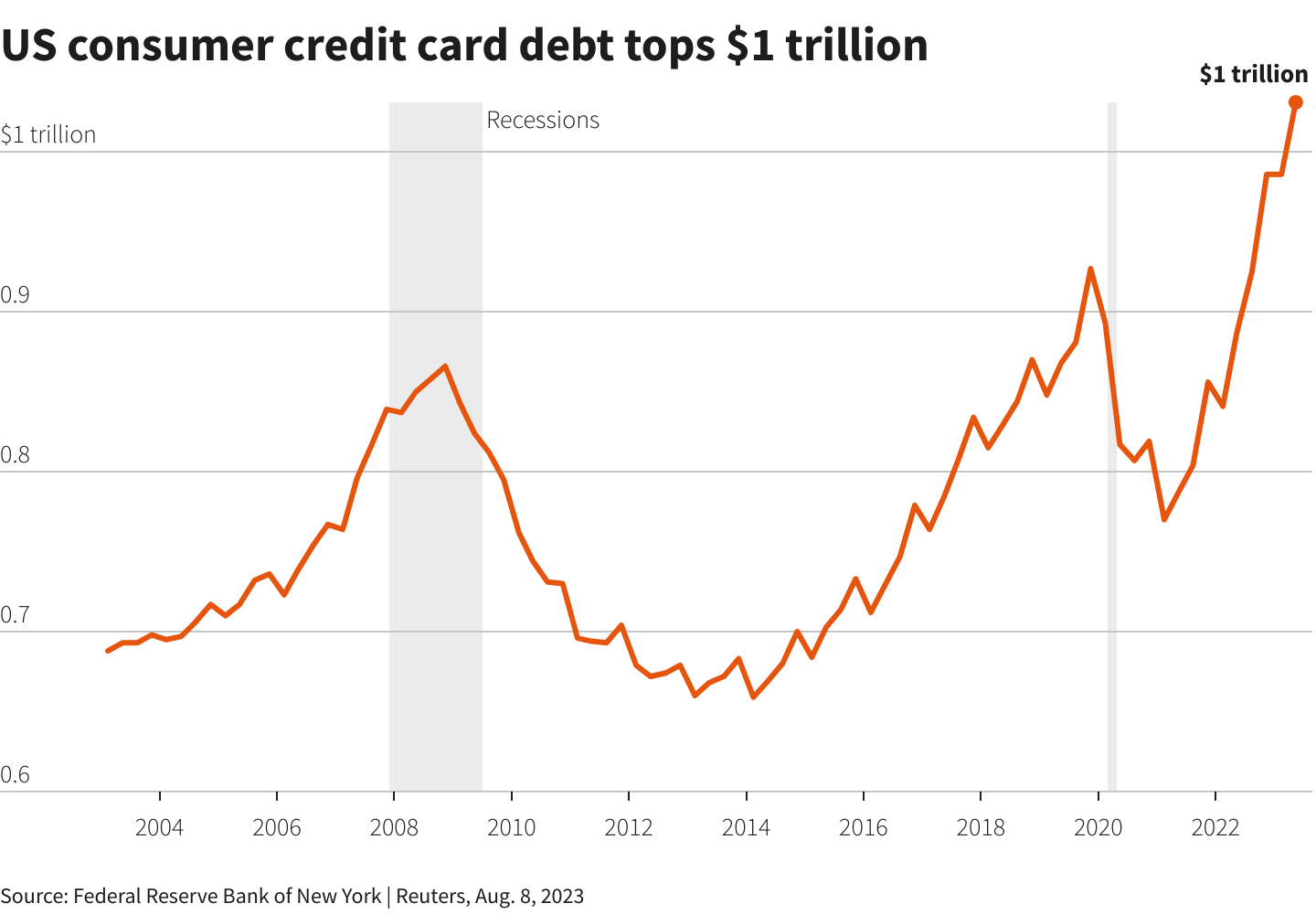

It is odd that so many people forgot about this. All “the sky is falling” posts about debt completely ignore this chart. What was weird was debt getting paid off during the pandemic. Not the rate of debt spending we’re back to post pandemic.

Could there be a Freddie Mac and Fannie Mae 2.0 coming in this case to automobiles?

Unlikely.

deleted by creator

Good news for the used car market. Lots of new inventory about to become available.

Bad news for American car manufacturers, who are already struggling while they’re in limbo between ICE and EV and can’t commit to either, but certainly will help to correct used car prices.

Don’t expect this to be a major economic factor to track going forward - many of these borrowers were likely already pushing their budget to afford the vehicle. If they financed with a variable rate while interest rates were rock bottom and government subsidies were peaking then this is exactly what you’d expect from the Fed rasing the interest rate.

Sure, some of these are due to unemployment and other circumstances but the major factor that changed was the prime interest rate, which can directly impact loan payments at a scale that is more directly measurable than something like unemployment, which is indirectly caused by the interest rate hike.

Commentators in the industry have been prognosticating about a subprime auto loan bubble burst for years and it keeps not happening, for whatever reason. Frankly I’m a bit surprised it hasn’t happened yet, but without some sort of engineered soft landing it feels like it has to be coming eventually. Car prices keep going up, loan terms keep getting longer, and the cost of borrowing is punishing right now. Negative equity in new loans keeps rising too. It’s only going to take a small systemic blip in people’s ability to pay to create a sudden spike in repossessions.